Capacity Addition 575 MW

Total operational capacity reached to 2,545 MW#

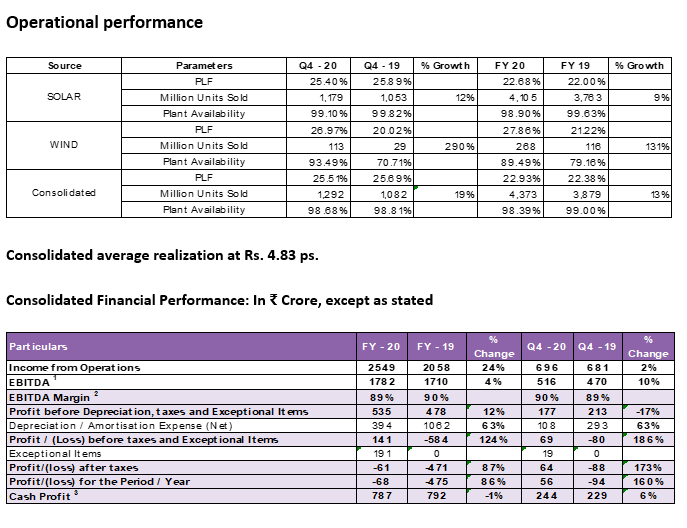

Revenues up 24% y-o-y to ₹ 2,549 crore

EBITDA1 up 4% y-o-y to ₹ 1,782 crore

EBITDA2 margins at 89%

Cash profit3 of Rs. 787 crore

Ahmedabad, May 4, 2020: Adani Green Energy Limited (AGEL), a part of the Adani Group, today announced its financial results for year and quarter ended March 31, 2020.

|

FINANCIAL HIGHLIGHTS FY20 (Y o Y)

Q4 FY20 (Q o Q)

OPERATIONAL HIGHLIGHTS Total Portfolio

|

# additionally commissioned 50 MW Solar plant in April 2020.

|

FY 20 Performance ( Y o Y )

Revenue

Total Revenue increased by 24% to ₹ 2,549.

Revenue from Power generation up by 8% to ₹ 2,065 crore due to additional project commissioning and full period operationalisation impact. Number of units sold up by 13% to 4,373 Mu’s.

EBITDA and EBITDA Margins

EBITDA1 for the year increased by 4% to ₹ 1,782 crore due to increased operating capacity.

EBITDA margin2 during the year was 89% compared to 90% last year. EBITDA1 for year got impacted by exceptional cost incurred on the international projects that are sold or called off during the year.

Depreciation and Amortization

Till FY19, The Group was following Written Down Value (WDV) depreciation method. Based on evaluation during the year, AGEL considered to change the depreciation method from WDV to Straight Line Method (SLM) and has given effect from April 1, 2019.

Due to change in depreciation method, there is reduction in depreciation and amortization. Depreciation for FY20 is ₹ 394 crore as against is ₹ 1062 crore y-o-y and Depreciation for Q4 FY20 is ₹ 108 crore as against ₹ 293 crore y-o-y.

Finance Cost

Interest and other borrowing cost increase to ₹ 1,075 crore as compared to ₹ 985 crore y-o-y due to charging of Interest due to projects which were being implementing were commissioned in FY20 and additional debt on account of ramp up of capacity and refinancing.

Exceptional Item

The Group has refinanced its earlier borrowings through issuance of secured senior notes (US$ denominated bonds) and rupee term loans from bank and financial Institutions. On account of such refinancing activities, the Group has incurred one-time expenses aggregating to ₹ 173 crore during the year. These expenses comprise of prepayment charges, unamortized portion of other borrowing cost related to earlier borrowings and cost of premature termination of derivative contracts.

Further, during the quarter the group has incurred one time exceptional loss of Rs. 19 crore because of sale of the Midland project in USA.

Profit / Loss before exceptional items

Profit before exceptional item is ₹ 123 crore as against loss of ₹ 475 crore y-o-y.

Cash Profit3

Cash Profit3 for the year at ₹ 787 crore. Cash profit for the year is impacted by the exceptional cost for international projects, which are sold or called off.

Q4 FY20 ( Q o Q)

Revenue

Revenue from power generation increased by 10% to ₹ 601 crore due to increase in operational capacity.

EBITDA and EBITDA Margins

EBITDA1 increase by 10% at ₹ 516 crore. EBITDA margin2 during quarter was 91% compared to 89% Q o Q. Increase in EBITDA1 and margin is attributable to operational efficiency.

Profit / Loss before exceptional items

Profit before exceptional items is ₹ 75 crore as compared to loss of ₹ 94 crore Q o Q.

Balance Sheet

As on 31st March, 2020, Gross debt was at ₹ 13,943 crore (Excludes inter corporate deposits and lease liability) and Net debt was ₹ 11,470 crore (Gross debt less cash and cash equivalents including FD and MF and Power sales receivables).

Projects

The Group has won bids for 130 MW wind and 1,300 MW Hybrid in FY20. Post completion of all the bids won and projects under implementation, the Group’s operational capacity would be 5,9906 MW.

Major Event

During the quarter, Adani Green Energy Limited (Holding Company), Adani Green Energy Twenty Three Limited (Subsidiary of the Holding Company) and TOTAL Solar Singapore Pte Limited (TOTAL) have entered into a Joint Venture Agreement (JVA) to accept 50% approximately 3,700 Crore investment in form of Equity and other instruments from TOTAL for 2148 MW of operational solar projects of the Group. The Board of AGEL dated March 23, 2020 has approved the transactions.

The JVA describes the terms to regulate the operation and management of the subsidiaries companies, govern their relationship as security holders of the JV Company and exercise certain rights and obligations with respect to their ownership of securities of the JV Company.

The said transaction and JV agreement is completed on 7th April, 2020 after receipt of due regulatory and statutory approvals.

Commenting on the quarterly results of the Company, Mr. Gautam Adani, Chairman, Adani Green Energy Limited said, “Adani Group has always maintained sustainability as a priority at the group. With the long-lasting impact that COVID-19 is due to have on all sectors, sustainability driven business is imperative. Green Energy and Renewable Energy motivated investments will continue in this coming fiscal year. At Adani Group, we are committed towards nation building and ensuring electrification for the growth of the economy. We are confident in emerging stronger at the end while delivering value to all stakeholders”

Mr. Jayant Parimal, CEO, Adani Green Energy Ltd said, “Adani Green Energy Limited is determined to cement its place as a leading renewable energy player in India. With our completed mergers and joint ventures, the most recent one being with Total, we have showcased strong performance. COVID-19 disruption has not materially affected the renewable plant operations, billing or collections from counterparties. Renewable energy plants enjoys a must-run status will continue to operate and generate at optimum level, in our assessment. All under-construction activity which was mandatorily suspended during lockdown, is poised to restart, as per GoI guidelines”

Notes:

1. Calculation of EBITDA excludes foreign exchange (gain) / loss , Other Income and extraordinary items.

2. EBITDA margin % represents EBITDA earned from Power Generation and excludes other items. Revenue from Power Generation includes Generation Based Incentive (GBI).

3. Cash profit = EBITDA1 + Other Income – Interest and other borrowings cost – current tax including earlier periods.

4. Capacity Utilisation Factor is calculated post capitalization.

5. Includes units generated during plant stabilization period, against which the revenue has been capitalised during the quarter ₹3.59 Crore (13 Mu’s) and for FY20 ₹26.35 Crore (96 Mu’s)

6. AGEL has entered in a definitive share purchase agreement to acquire beneficial interest in the OEM wind projects of 150 MW subject to fulfillment of conditions precedent.