Operational RE Capacity grows 37% YoY to 11.6 GW, continues to be India’ largest

Contributed 15% of nationwide utility-scale solar and 12% of wind installations in CY24

EDITOR’S SYNOPSIS

|

|

Ahmedabad, 23 January 2025: Adani Green Energy Ltd (AGEL), India’s largest and fastest-growing pure-play renewable energy (RE) company, has announced financial results for the period ending 31 December 2024, showcasing significant growth and operational excellence.

FINANCIAL PERFORMANCE – Q3 & 9M FY25: (Rs. in crore)

|

Particulars |

Quarterly Performance |

Nine Monthly Performance |

||||

|

Q3 FY24 |

Q3 FY25 |

% change |

9M FY24 |

9M FY25 |

% change |

|

|

|

|

|

|

|

|

|

|

Revenue from Power Supply |

1,765 |

1,993 |

13% |

5,793 |

6,829 |

18% |

|

|

|

|

|

|

|

|

|

EBITDA from Power Supply 1 |

1,638 |

1,848 |

13% |

5,412 |

6,366 |

18% |

|

EBITDA from Power Supply (%) |

91.5% |

91.4% |

|

92.0% |

92.0% |

|

|

|

|

|

|

|

|

|

|

Cash Profit 2 |

862 |

991 |

15% |

2,944 |

3,630 |

23% |

-Strong revenue, EBITDA and Cash profit growth is primarily backed by robust greenfield capacity addition of 3.1 GW and consistent plant performance.

Mr. Amit Singh, CEO, Adani Green Energy Ltd, stated, "We are steadily developing the world’s largest RE plant in Khavda, Gujarat as well as large-scale plants in Rajasthan and other sites, supported by well aligned transmission planning. We have upgraded our supply chain to meet current and future regulatory compliances. Recently, we made significant progress in building the PPA pipeline by participating in various tenders. Our updated strategy now includes large-scale deployment of Battery Energy Storage Systems (BESS), given significant cost declines in last few quarters. BESS can be deployed relatively quickly and will be crucial in grid integration, supporting rapid renewable growth and complementing our existing solar, wind and hydro pumped storage projects. We continue to ensure that the financing tie up is completed well in advance for all our projects backed by a robust capital management program with a diversified pool of capital.”

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – 9M FY25:

- Project Development Excellence: AGEL has consistently expanded its greenfield capacities

backed by advanced resource planning, engineering, and supply chain management, with project

management, execution and assurance from our partners, Adani Infra India Ltd (AIIL).

- Operational Capacity: Expanded by an impressive 37% YoY to 11,609 MW, with greenfield additions, including 2,113 MW of solar capacity and 312 MW wind capacity in Khavda, 580 MW of solar capacity in Rajasthan and 126 MW of wind capacity in Gujarat.

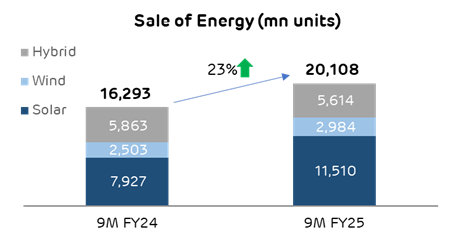

- Energy Sales: Increased by 23% YoY propelled by the robust capacity additions and strong operational performance.

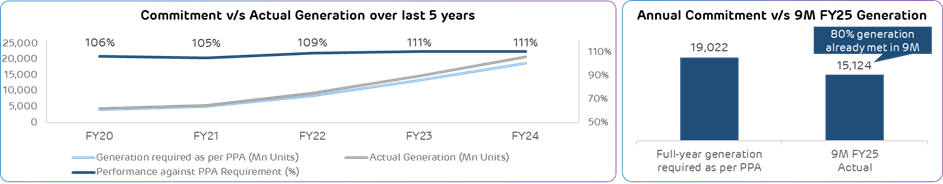

- Exceeding Commitments: AGEL has consistently generated electricity exceeding the overall annual commitment under the power purchase agreements. In FY24, AGEL’s PPA based electricity generation was 111% of the annual commitment. In 9M FY25, AGEL has already generated 80% of the annual commitment.

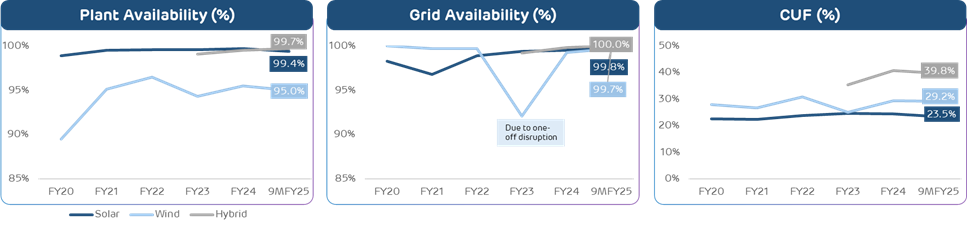

- O&M Efficiency: AGEL’s O&M is driven by advanced technology with Energy Network Operation Center enabling real time monitoring of the renewable plants across the country. This has not only enabled consistent higher plant availability in turn resulting in higher electricity generation but also led to reduction in O&M cost resulting in industry-leading EBITDA margin of 92.0%.

Operational Excellence: AGEL’s operations and maintenance (O&M) leverage sophisticated data analytics, enhanced by machine learning and artificial intelligence, in collaboration with our O&M partners, Adani Infra Management Services Pvt Ltd (AIMSL).

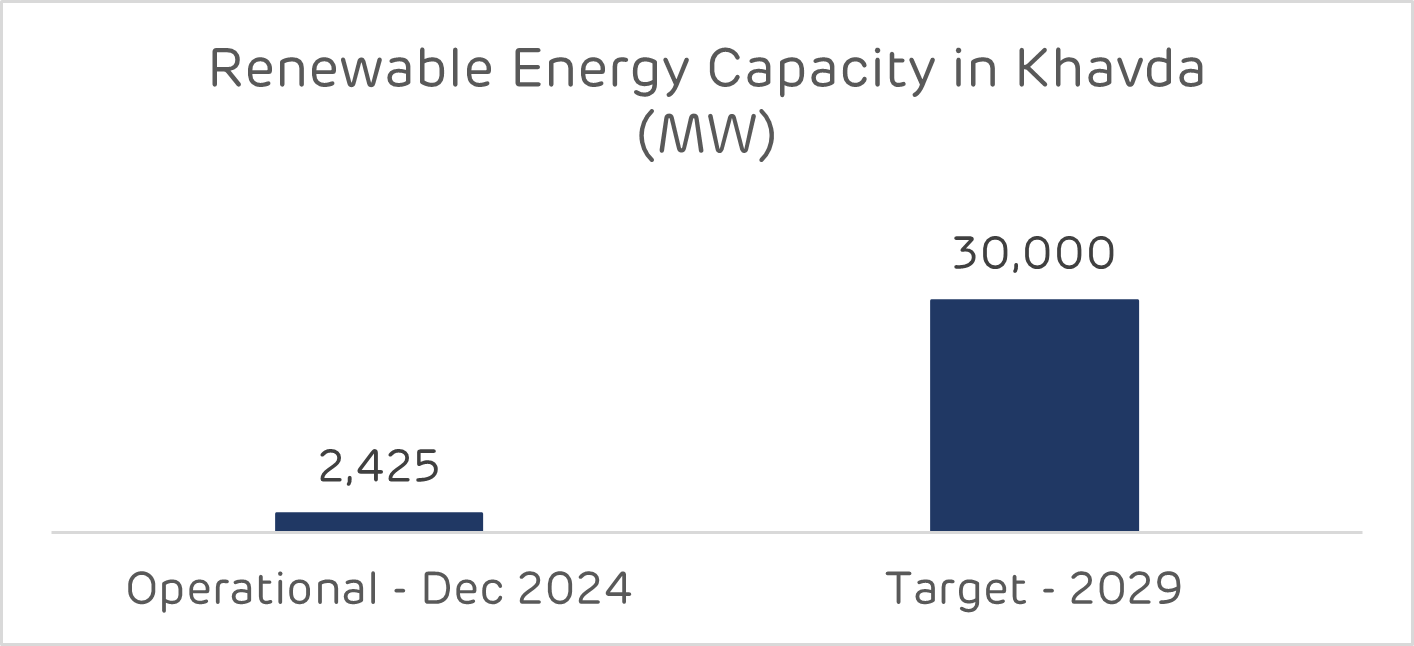

DEVELOPMENT OF THE WORLD’S LARGEST RE PLANT AT KHAVDA:

- World’s largest power plant: AGEL is developing a massive 30 GW renewable energy

plant at Khavda in Gujarat. This is spread over an area of 538 sq km, almost 5 times the

city of Paris. This project will set a global benchmark for development of ultra large-scale

renewable energy plant.

- Rapid execution: We have a workforce of over 12,000 putting in enormous efforts at the site. Four phases of transmission tendering for Khavda have been completed and the fifth phase of tendering is in progress, providing a significant visibility of RE capacity development in Khavda. Our capacity ramp-up plans continue to be well aligned with the transmission planning. Apart from having long term relationships with global solar module suppliers and a well-integrated supply chain within Adani portfolio, we have expanded our collaboration with more suppliers for ALMM compliant solar modules to boost solar capacity addition. These initiatives will enable significant capacity deployment in the last quarter of the current financial year and put us on a firm track to achieve 30 GW RE capacity in Khavda by 2029 setting a global benchmark for the speed of execution at such a large scale.

- Most advanced renewable technologies deployed: The plant deploys the most advanced bifacial solar modules and trackers to maximise electricity generation. It also deploys India’s largest 5.2 MW wind turbine, which is also one of the most powerful onshore wind turbines globally. These wind turbines harness the high wind speeds of ~ 8 meters per second available at Khavda and optimize the levelized cost of electricity. Khavda also deploys complete robotic cleaning, which not only leads to near zero usage of water for module cleaning but also increases electricity generation

ESG LEADERSHIP:

- Retained top ESG rankings: AGEL is committed to its ESG goals and has continued to retain

its top ESG rankings.

- Ranked 3rd in FTSE Russell ESG score in the

Alternative Electricity Subsector with a percentile rank of 93 in the Utilities

Supersector

- Ranked in ‘Leadership band’, A and A- rating awards in

CDP Suppliers Engagement Program and CDP Climate change disclosure

respectively

- 1st rank in Asia and top 10 globally in RE sector by ISS

ESG

- Amongst top 3 in RE sector in Asia Pacific by

Sustainalytics’s ESG assessment

- 1st rank in the power sector for third consecutive year as per the recent ESG score published by CRISIL

- Ranked 3rd in FTSE Russell ESG score in the

Alternative Electricity Subsector with a percentile rank of 93 in the Utilities

Supersector