Operationalizes Wind Power Capacity of 250 MW at Khavda deploying India’s Largest 5.2 MW Wind Turbine Generators

Achieves 3rd Rank in FTSE Russell ESG Assessment in the Alternative Electricity Segment, Securing Top Governance Score of 5.0

|

|

Ahmedabad, 25 July 2024: Adani Green Energy Ltd (AGEL), India’s largest and fastest-growing pure-play renewable energy company, has announced financial results for the quarter ending 30 June 2024, showcasing significant growth and operational excellence.

FINANCIAL PERFORMANCE – Q1 FY25:

|

Particulars |

Quarterly Performance |

||

|

Q1 FY24 |

Q1 FY25 |

% change |

|

|

Revenue from Power Supply |

2,045 |

2,528 |

24% |

|

EEBITDA from Power Supply 1 |

1,938 |

2,374 |

23% |

|

EBITDA from Power Supply (%) |

92.5% |

92.6% |

|

|

|

|||

|

Cash Profit 2 |

1,051 |

1,390 |

32% |

- The robust growth in revenue, EBITDA and cash profit is primarily driven by a capacity addition of 2,618 MW over the last year.

Mr. Amit Singh, CEO of Adani Green Energy Ltd, stated "We are working relentlessly towards the development of world’s largest single-location renewable energy plant of 30 GW at Khavda in Gujarat. To enable accelerated implementation, we have deployed advanced robotics technology for installation of solar modules, significantly enhancing productivity. Additionally, we have developed an extensive local supply chain and established a sustained mobilization of human resources.”

He further said “Adani Green is well on track to achieve its 2030 capacity target of 50 GW including at least 5 GW energy storage in the form of pumped hydro, with sites already secured and clear visibility on evacuation. The global recognition of our ESG efforts further strengthens our resolve to deliver sustainable, industry-leading growth.”

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – Q1 FY25:

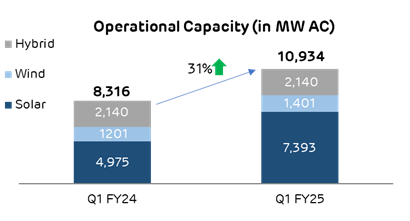

- Operational Capacity: Expanded by an impressive 31% YoY to 10,934 MW, with greenfield additions, including 2,000 MW of solar capacity in Khavda, 418 MW of solar capacity in Rajasthan and 200 MW of wind capacity in Gujarat.

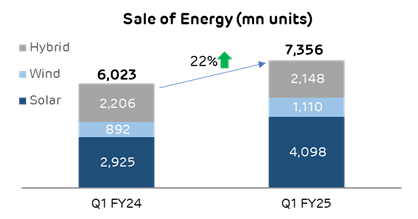

- Energy Sales: Increased by 22% YoY propelled by the robust capacity additions and strong operational performance.

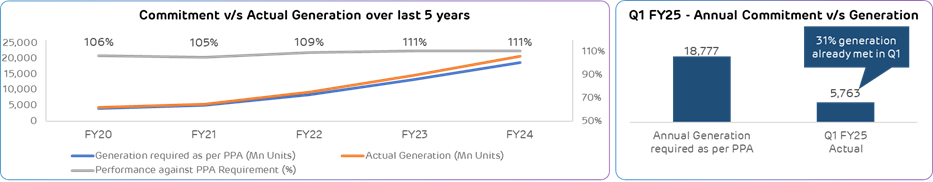

- Exceeding Commitments: AGEL has consistently generated electricity exceeding the overall annual commitment under the power purchase agreements. In FY24, AGEL’s PPA based electricity generation was 111% of the annual commitment. In Q1 FY25, AGEL has already generated 31% of the annual commitment.

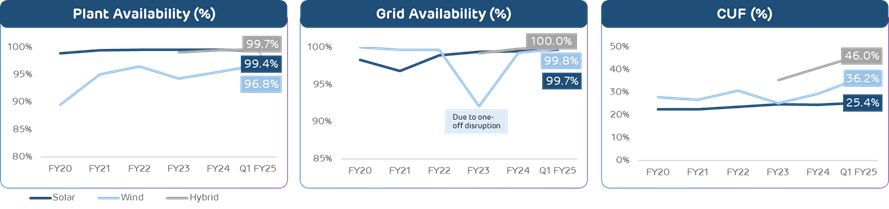

- O&M Efficiency: AGEL’s O&M is driven by advanced technology with Energy Network Operation Center enabling real time monitoring of the renewable plants across the country. This has not only enabled consistent higher plant availability in turn resulting in higher electricity generation but also led to reduction in O&M cost resulting in industry-leading EBITDA margin of 92.6%.

DEVELOPMENT OF THE WORLD’S LARGEST RE PLANT AT KHAVDA:

- - World’s largest power plant: AGEL is developing a massive 30 GW renewable energy plant at Khavda in Gujarat. This is spread over an area of 538 sq km, almost 5 times the city of Paris. This is not only the world’s largest single-location renewable energy plant but also the world’s largest single-location power plant across all power sources. This project will set a global benchmark for development of ultra large-scale renewable energy plant.

- - Rapid execution: Within 12 months of breaking ground, AGEL already operationalized the first 2 GW. AGEL plans to add a total of 6 GW capacity in FY25 and Khavda will contribute a major part of this capacity. The entire 30 GW RE capacity will be developed in Khavda by 2029 also setting a global benchmark for the speed of execution at such a large scale.

- - Most advanced renewable technologies deployed: The plant deploys the most advanced bifacial solar modules and trackers to maximise electricity generation. It also deploys India’s largest 5.2 MW wind turbine, which is also one of the most powerful onshore wind turbines globally. These wind turbines harness the high wind speeds of ~ 8 meters per second available at Khavda and optimize the levelized cost of electricity. Khavda also deploys complete robotic cleaning, which not only leads to near zero usage of water for module cleaning but also increases electricity generation.

- - Massive ESG contribution from 30 GW plant:

- ~81 billion units of clean electricity to be generated

- 16.1 million households to be powered

- 15,200+ green job creation

- 58 million tons of CO2 emissions will be avoided

- Emissions avoided equivalent to:

- 60,300 tonnes of coal avoided

- 12.6 million cars off the roads

- - Progress:

- 30 GW site already secured

- Clear visibility of phase wise evacuation ensuring its availability well ahead of operationalization of the capacities

- First phase common infrastructure in place including extensive social infrastructure

- Workforce of over 8,000 people already mobilized

- Extensive supply chain planning with focus on localization: Solar module procurement from Bloomberg tier 1 suppliers, wind turbine procurement from Adani New Industries and extensive local supply chain developed for other equipment

- 2.25 GW capacity already operational

- - Latest addition of 250 MW Wind capacity at Khavda: On July 24, 2024, AGEL has announced the operationalization of a 250 MW wind capacity at Khavda. This milestone brings the cumulative operational capacity at the Khavda plant to 2,250 MW. It strengthens AGEL’s leadership in India with the largest operational portfolio of 11,184 MW.

CREDIT RATING UPDATE:

- Rating Upgrade: India Ratings and Research (Ind-Ra) has upgraded AGEL’s Long-Term Issuer Rating to 'IND AA-’ from ‘IND A+’ factoring in the strong operational performance, continuously improving leverage and healthy cash flows.

ESG UPDATES

- - Top ESG ranking by FTSE Russel: AGEL has been ranked 3rd in FTSE Russell ESG assessment in the Alternative Electricity Subsector with a percentile rank of 93 in the Utilities Supersector. AGEL has improved its overall score to 4.2 out of 5, up from 3.7, significantly above the alternative electricity sub-sector average of 2.9.

Notably, AGEL achieved the top score of 5 in the Governance theme and received the high scores in the Social and Environment themes, including 5 in Labour Standards and in Pollution & Resources in the Environment theme. - - Constituent of FTSE4Good index: AGEL continues to be a part of the FTSE4Good Index Series for the past three years.

- - Continued top ESG rankings by ISS ESG and Sustainalytics:

- Ranked in the top 5 RE companies by ISS ESG

- Ranked in the top 10 RE companies by Sustainalytics

- - Contribution to UN Sustainable Goal 6 with Water Conservation Leadership: AGEL has deployed robotic cleaning across 4,760 MW of operational renewable plants, saving 347 million liters of water annually. This is crucial for water conservation in water stressed areas like Khavda. This initiative, along with other initiatives such as semi-automatic module cleaning and water recharge through desilting of water bodies at the older plants, has earned AGEL ‘water positive’ certification for all its operational plants with capacities exceeding 200 MW. AGEL aims to be water positive across all plants by FY26.